We are delighted to announce Atrato Onsite Energy’s latest annual results for the period ended 30 September 2023.

Click here to read the full RNS, download our annual report and results presentation, or click here to listen to the presentation.

For professional investors only. Capital at risk

Highlights:

Since IPO, Atrato Onsite Energy has deployed £198m into a diversified portfolio of solar assets with 182MW capacity. The portfolio is expected to be fully operational by March 2024. The company announced a 10% increase in the target dividend for FY24 to 5.5p per share.

As at the reporting date, the assets within our portfolio have an average contracted revenue term of 11 years, and 93% of our revenue is contracted under either Power Purchase Agreements, or subsidy’s.

Atrato Onsite Energy is a leading corporate and industrial solar platform in the UK, with one of the longest contracted income profiles and one of the lowest exposures to volatile merchant prices.

The diverse portfolio delivers value by offering growth potential from installation projects.

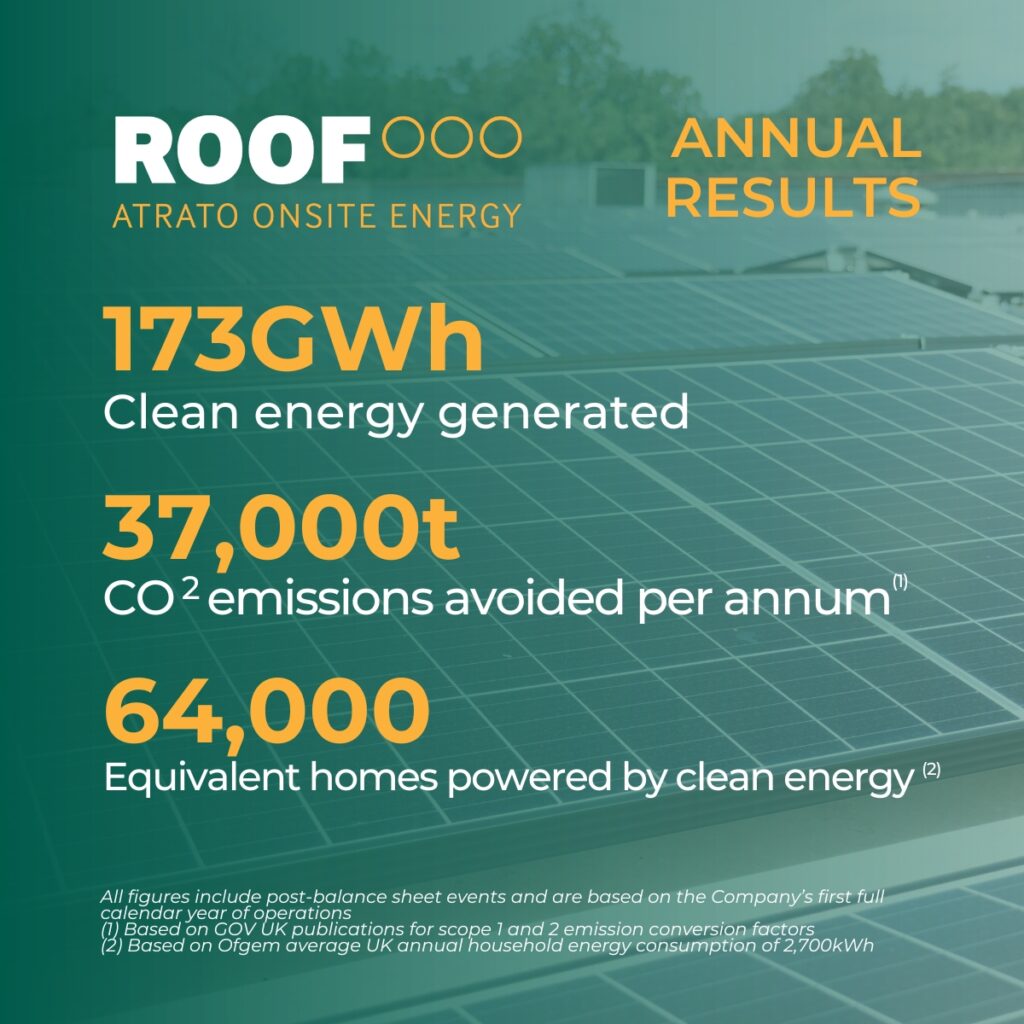

As a sustainability led fund, Atrato Onsite Energy strives to have a positive impact as a result of its operations. The current portfolio could generate 173GWh of clean energy annually. This generation equates to 37,000 tonnes of CO2 emissions avoided, and is equivalent to powering 64,000 homes, roughly the size of Middlesborough.

Atrato Onsite Energy is a supporter of the United Nations Sustainable development goals, The Task Force on Climate-related Financial Disclosures (TCFD), The Principles for Responsible Investment (PRI), as well as being a signatory of The Net Zero Asset Managers Initiative. The company also received the green economy mark from the London Stock Exchange when the fund first listed in 2021.

Click here to read the full RNS, download our annual report and results presentation, or click here to listen to the presentation.